Annual Report 2012–13

年報

91

2013

2012

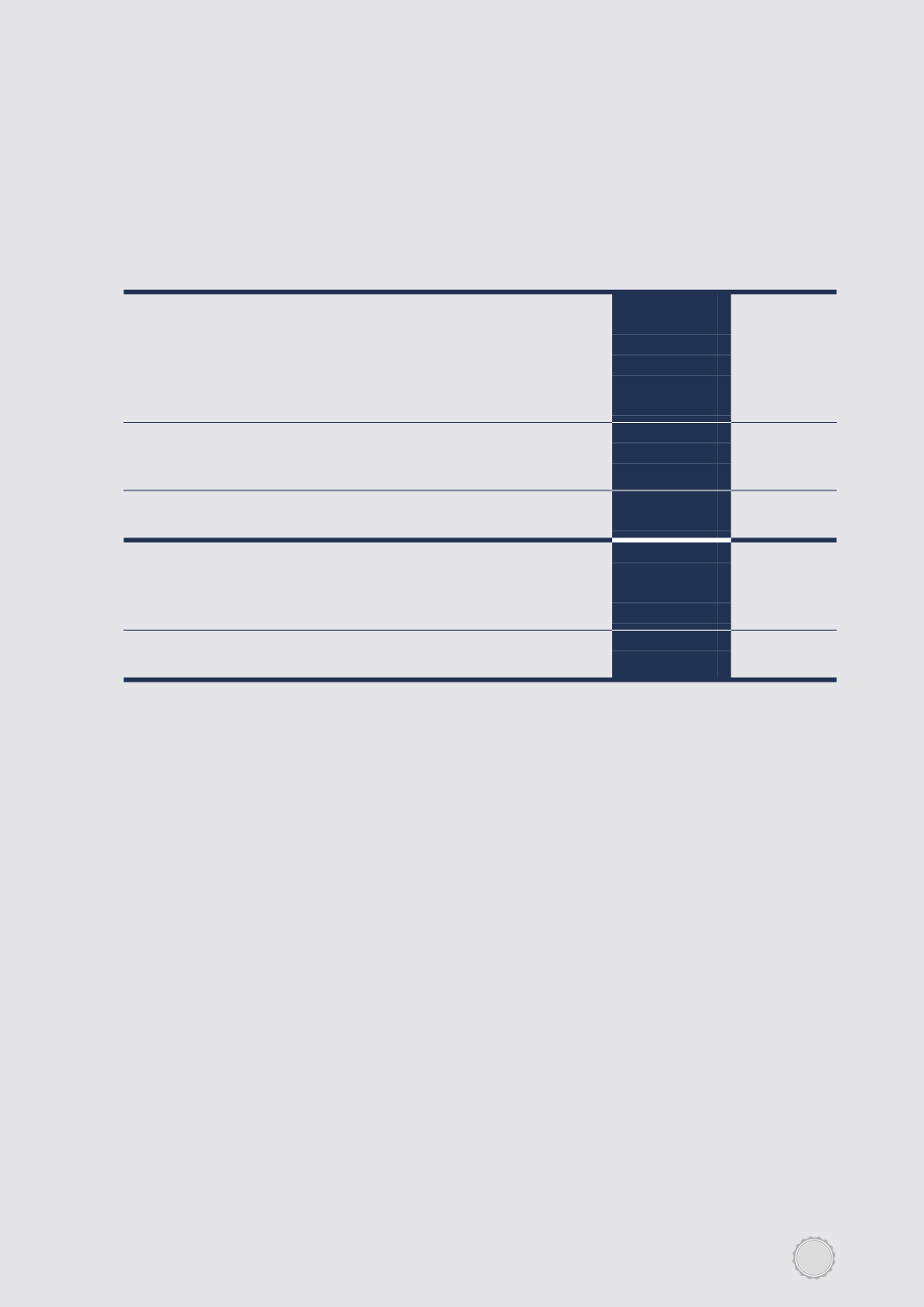

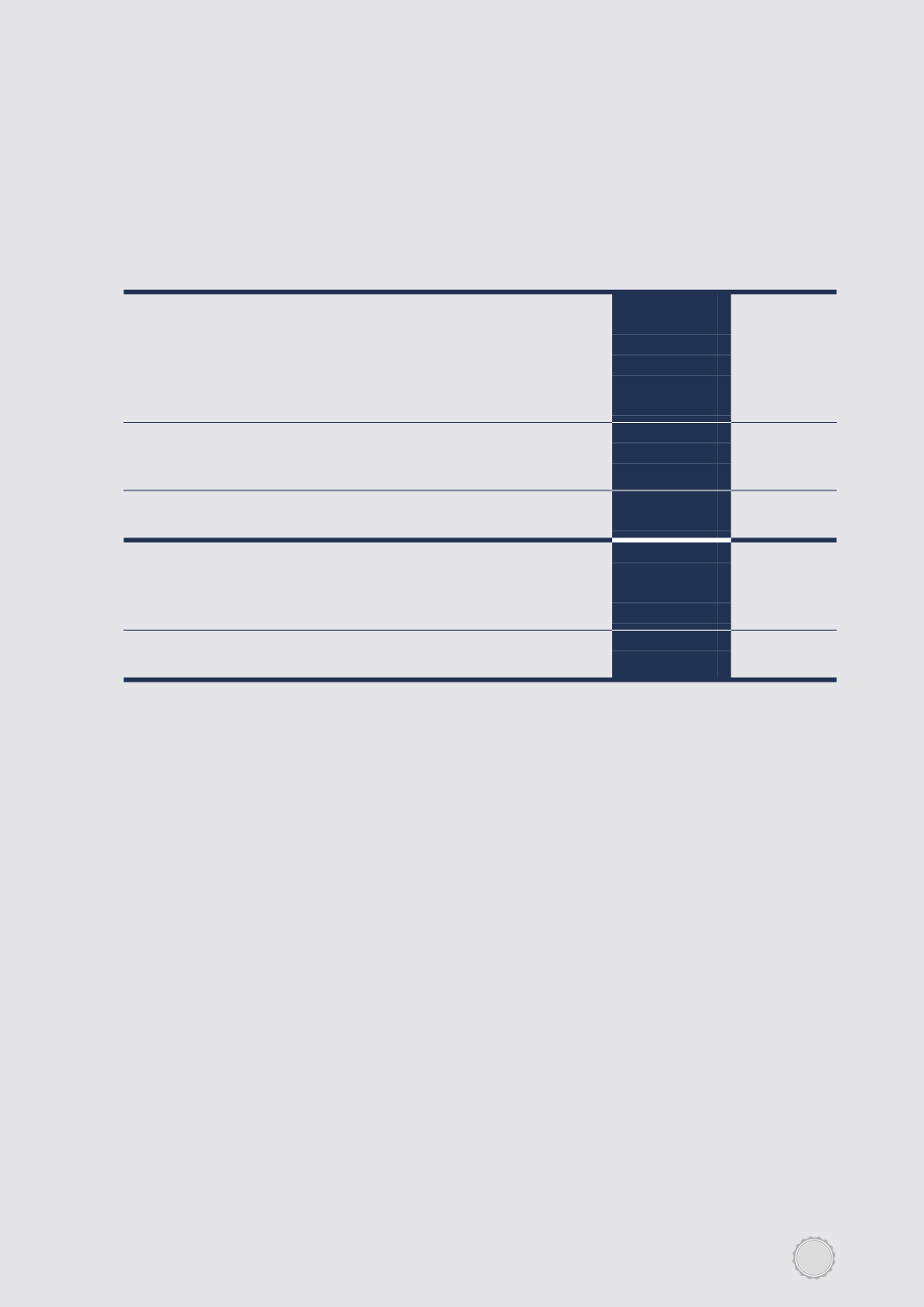

按攤銷成本列帳

上市:

At amortised cost

Listed:

—

本港

— in Hong Kong

55,397

55,350

—

本港以外

— outside Hong Kong

15,123

15,100

70,450

70,520

非上市

Unlisted

30,932

30,715

101,165

總額

Total

101,452

列為:

Classified as:

流動資產

Current assets

46,055

—

非流動資產

總額

Non-current assets

Total

55,397

101,165

101,452

101,165

財務報表附註

(續)

Notes to the Financial Statements

(continued)

10.

持至期滿的證券

Held-to-maturity securities

11.

外匯基金存款

Placement with

the Exchange Fund

外匯基金存款結餘為

4.385

億港元(二零一二年:

4.152

億港元),其中

4

億港元為原有存款,

3,850

萬港元(二零一二年:

1,520

萬港元)為報告期結束日已入帳但尚未提取的利息。該存款為期六年

(由存款日起計),期內不能提取原有存款。

The balance of the placement with the Exchange Fund amounted to HK$438.5 million (2012: HK$415.2

million), being the original placement of HK$400 million plus HK$38.5 million (2012: HK$15.2 million)

interest paid but not yet withdrawn at the end of the reporting period. The term of the placement is six

years from the date of placement, during which the amount of original placement cannot be withdrawn.

外匯基金存款利息按每年

1

月釐定的固定息率計算。該息率是基金投資組合過去

6

年的平均年度

投資回報,或

3

年期外匯基金債券在上一個年度的平均年度收益,兩者取其較高者,下限為

0%

。

二零一三年固定息率為每年

5.0%

,二零一二年為每年

5.6%

。

Interest on the placement is payable at a

fixed rate determined every January. The rate is the average

annual investment return of the Exchange Fund’s Investment Portfolio for the past six years or the average

annual yield of three-year Exchange Fund Notes for the previous year subject to a minimum of zero percent,

whichever is the higher. The interest rate has been fixed at 5.0% per annum for the year 2013 and at 5.6%

per annum for the year 2012.